Are you dreaming of starting an Airbnb business but not sure whether it’ll be worth it? Are you wondering “Is Airbnb profitable for hosts?”. Maybe you’re worried about the costs, confused by the red tape, or unsure how much time you can dedicate to running your own business.

While it may seem daunting, becoming an Airbnb host can be an amazing journey. You just need to have the adventurous spirit and the grit that it takes to be successful.

In this blog post, we’ll cover everything you need to know about building a profitable Airbnb business. You’ll find out how to:

- Calculate your estimated Airbnb income potential.

- Predict your Airbnb operating costs.

- Automate your Airbnb rental and get to profitability faster.

Let’s dive in!

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

Is Owning an Airbnb Profitable for Hosts?

Running an Airbnb business is like running any other business: it can be profitable if you figure out the right way to do it. To succeed, you need to invest your money, time, and effort, and you need to have a well-thought-out business plan.

It doesn’t hurt to adopt an entrepreneurial mindset from the very beginning: take risks, experiment, and be agile when you need to adjust your strategy.

Related post: How to Get More Bookings on Airbnb: 10 Tips for Hosts

How Much Can I Earn with Airbnb?

Whether you manage to build a profitable Airbnb business will largely depend on your level of commitment and your willingness to learn. That being said, there are ways to roughly calculate how much you could be earning from an Airbnb listing before you decide to jump in.

Here’s how to figure out whether owning an Airbnb rental would be profitable for you:

Step 1: Calculate your Airbnb income potential

Before you start an Airbnb, it’s important to make sure that your revenue will either match or exceed your expectations.

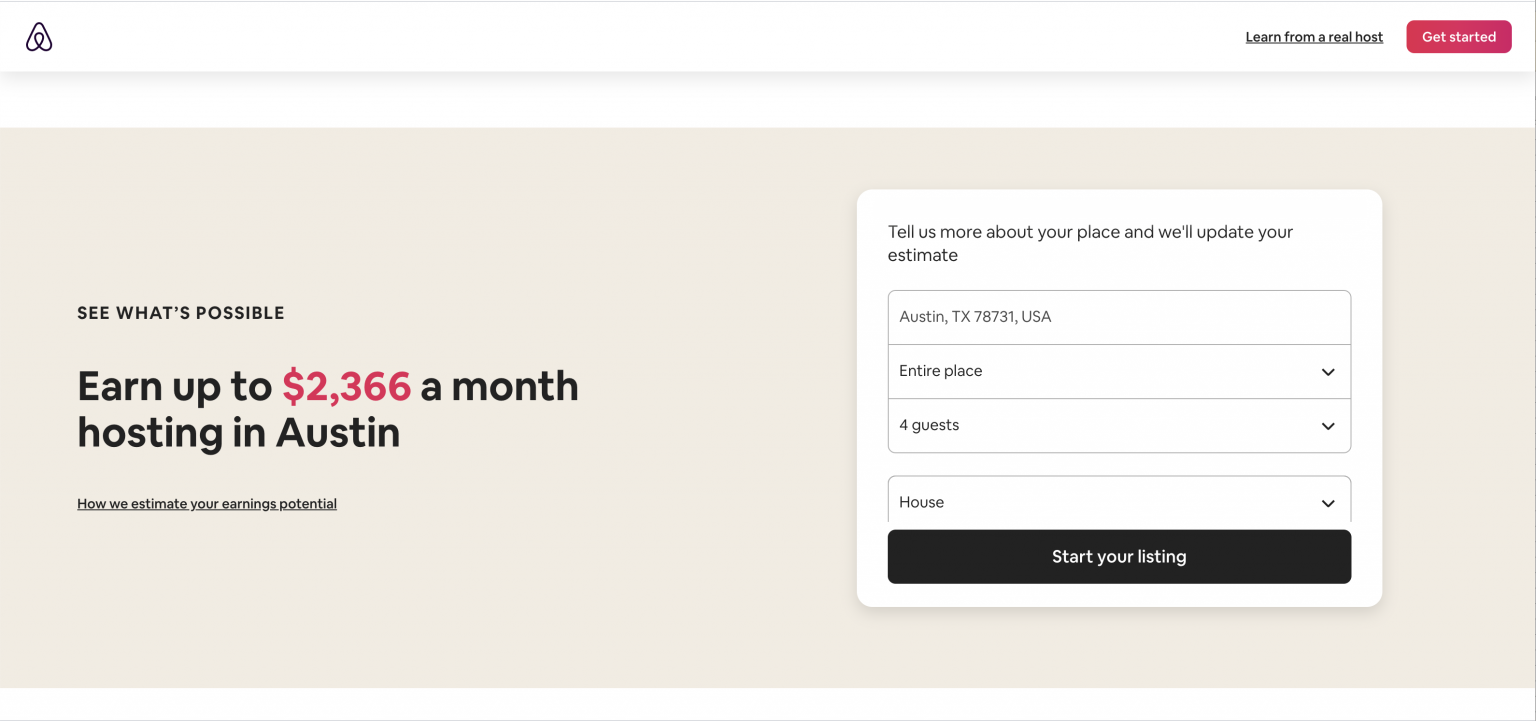

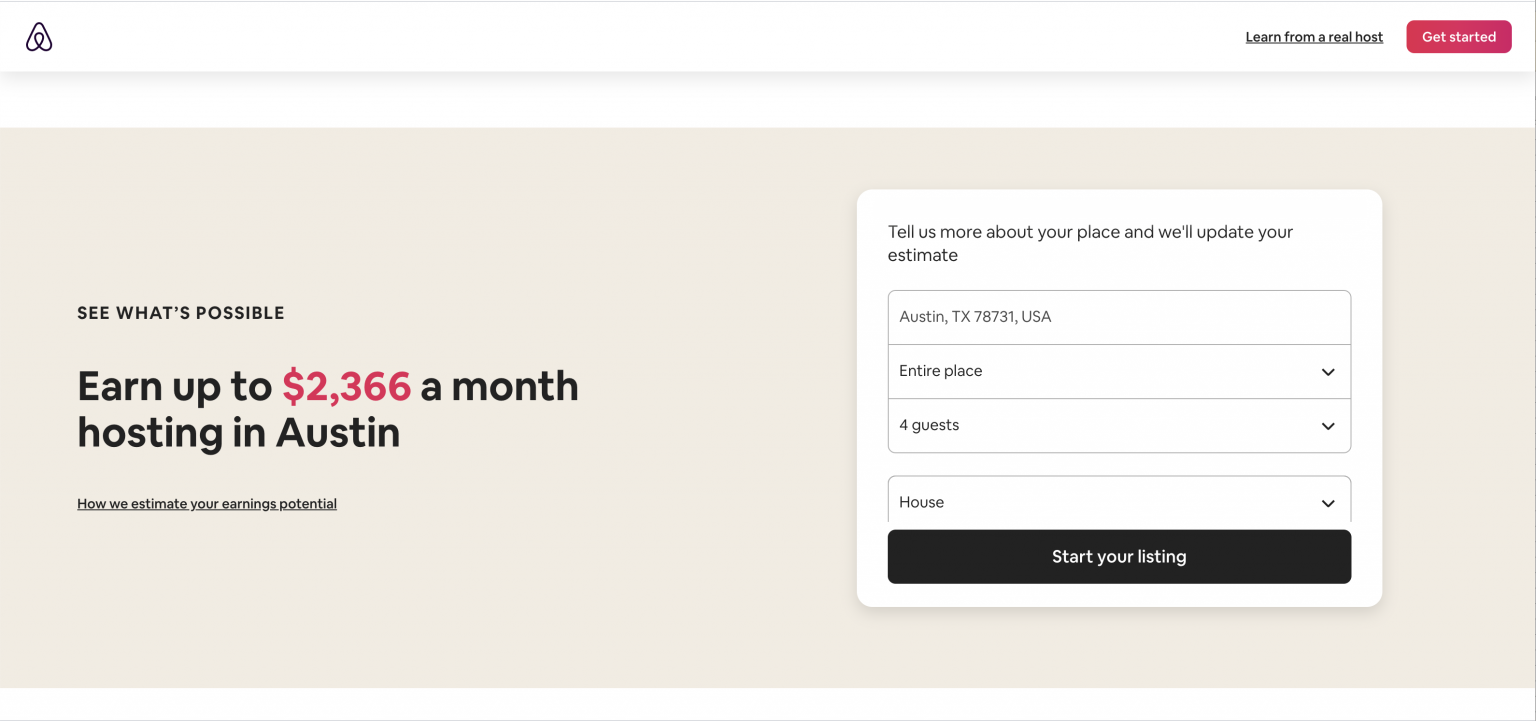

Airbnb has a calculator that will give you an estimation of how much you can expect to earn. It looks at booking data from the last two years for your location, multiplying the average nightly rate by the average occupancy rate to arrive at your estimate.

Just type in some details about your property such as location, listing type (entire place or room), and number of guests and the calculator will tell you how much you can expect to earn.

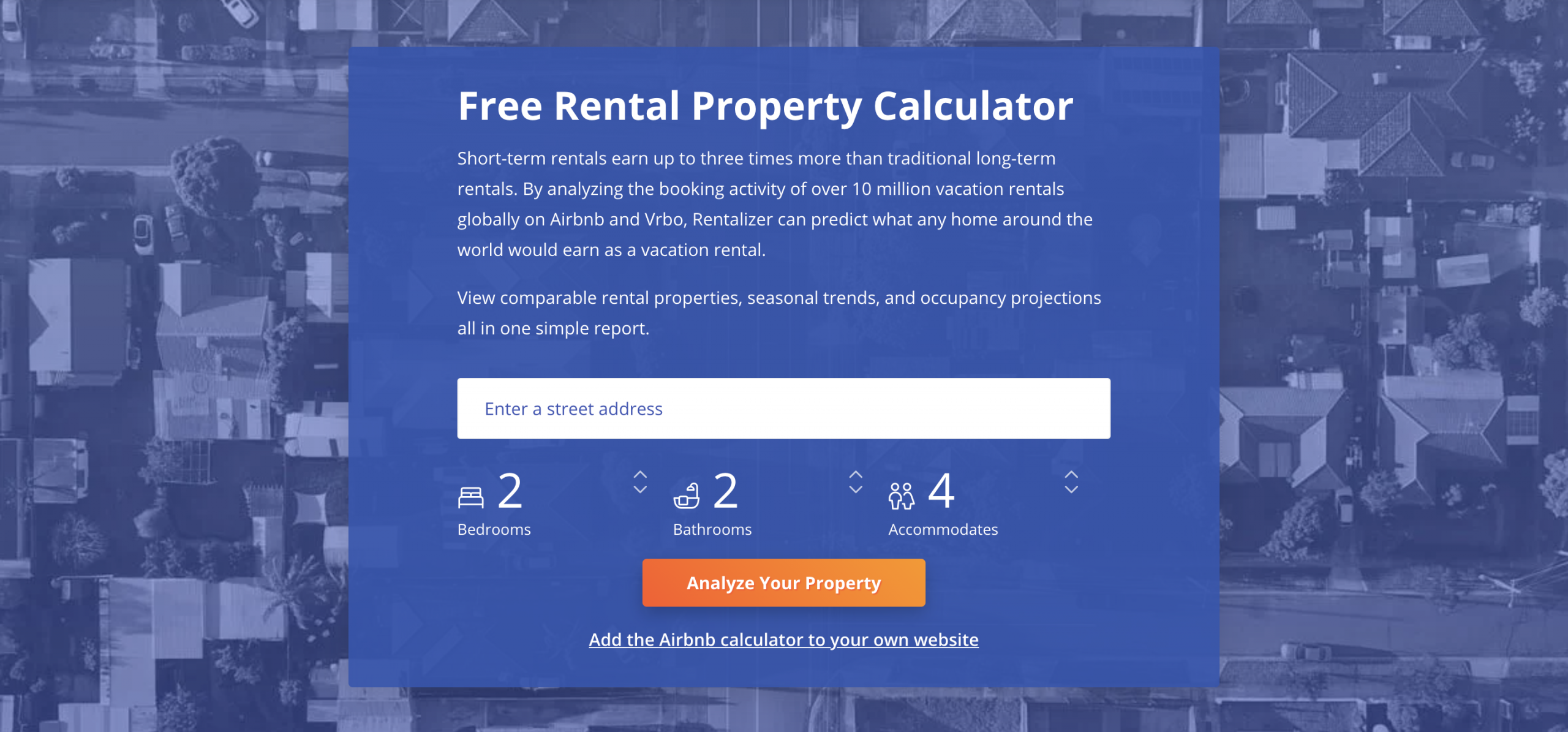

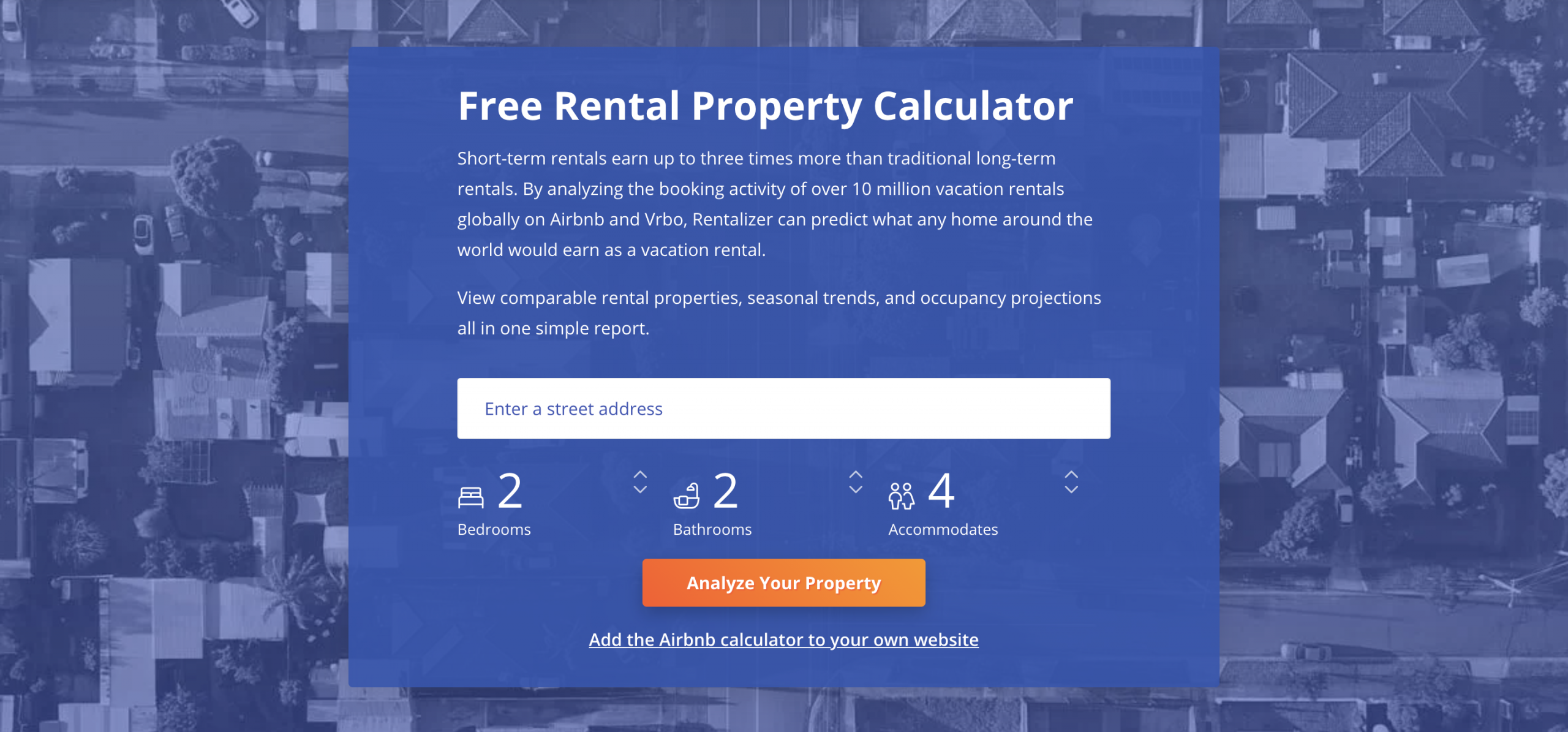

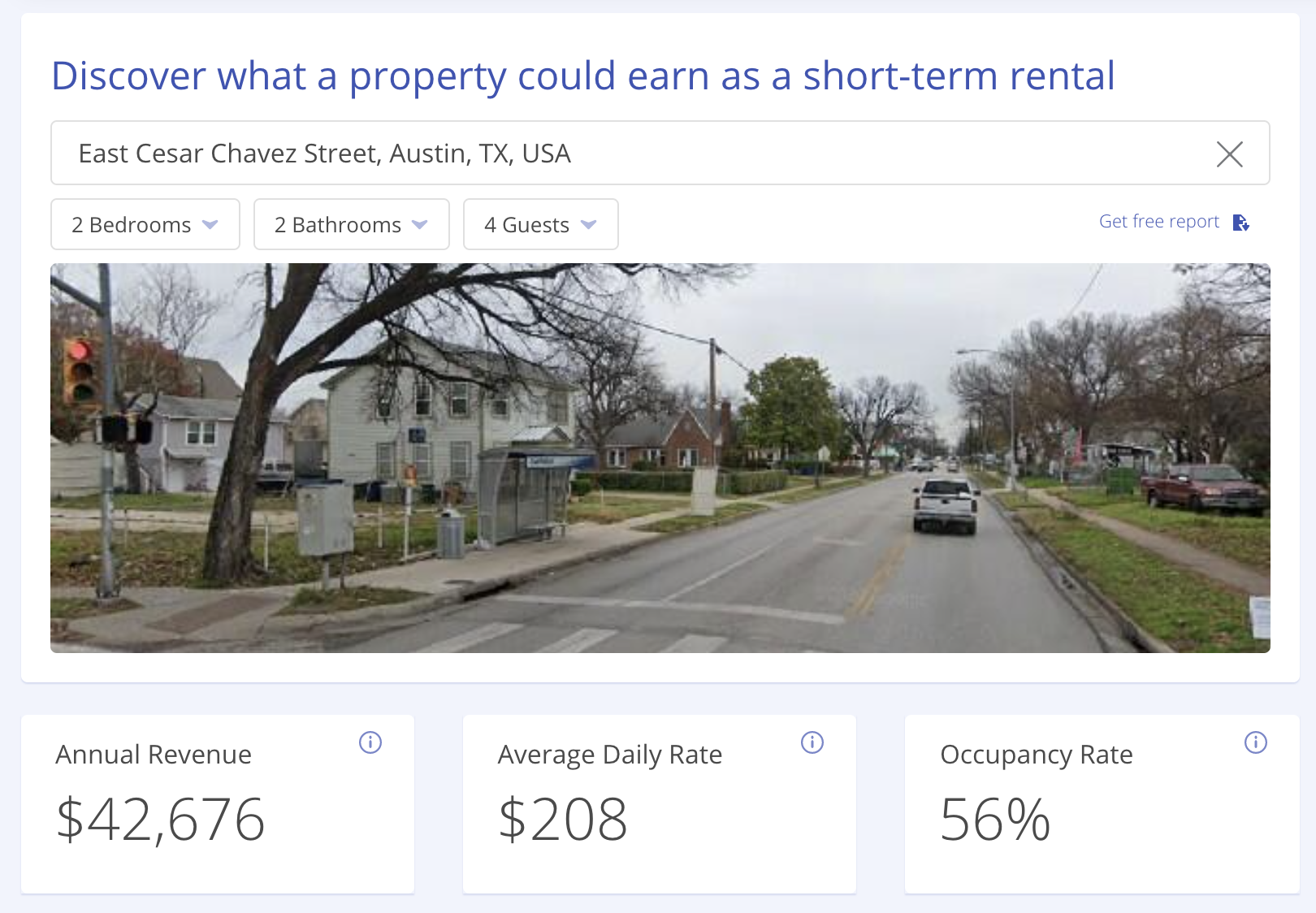

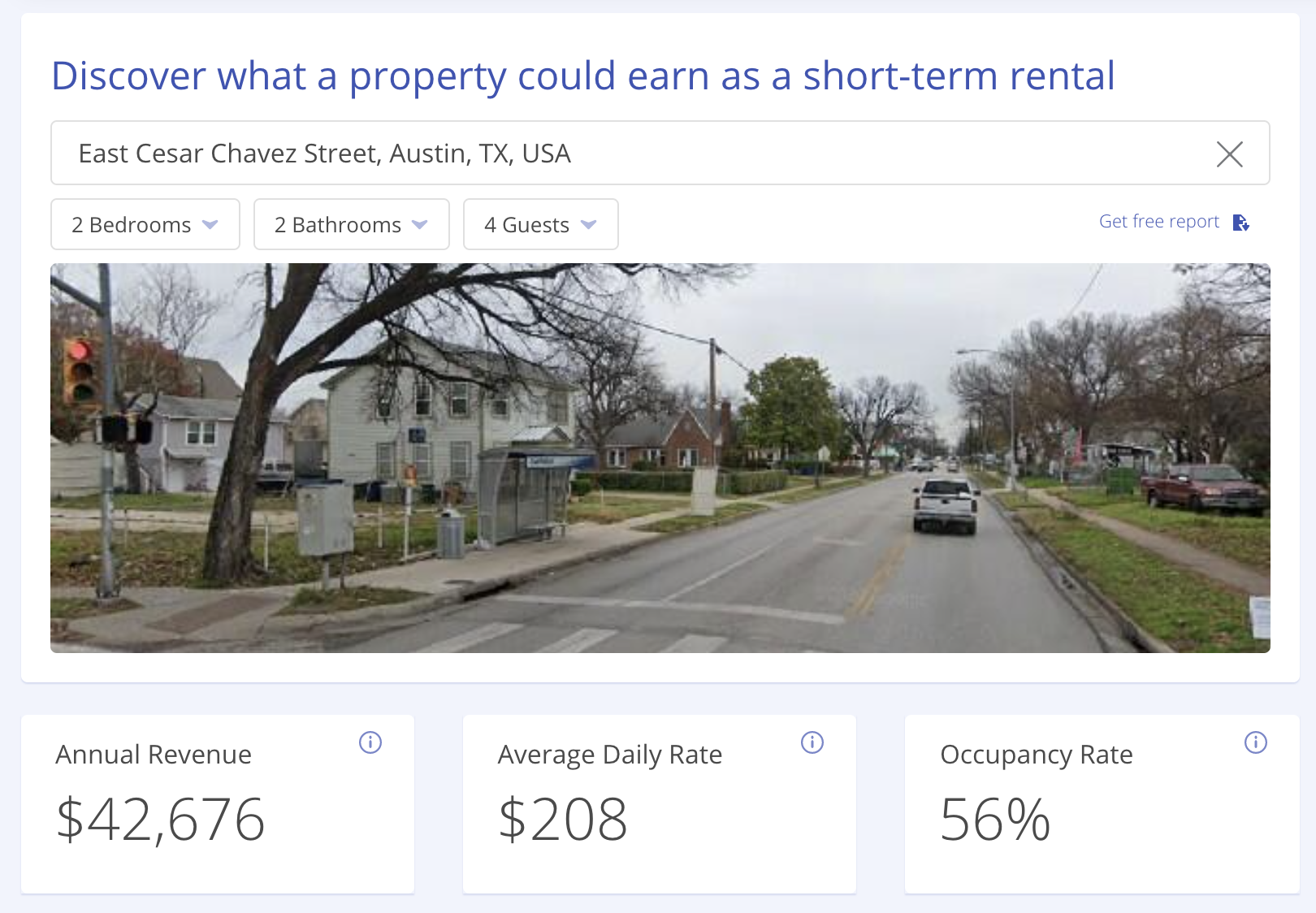

Another free tool that you can use to calculate your Airbnb income potential is AirDNA’s Rentalizer. As a market-leading vacation rental data provider, AirDNA analyzes the booking data of over 10 million listings around the world on Airbnb and Vrbo.

As a result, not only can the Rentalizer predict how much you can make but it can also provide other useful insights such as similar properties in your area, seasonal trends, and occupancy projections in a single, free report.

Step 2: Calculate your Airbnb operating costs

Once you know your expected average nightly rate and how much your property could make as a short-term rental in a year, you also need to calculate your costs.

There are more costs associated with running an Airbnb business than most first-time hosts expect.

Here are the most significant expenses of operating an Airbnb rental:

- Business licenses and taxes. In some jurisdictions, vacation rental hosts need to get business licenses and pay special taxes to legally run an Airbnb. The cost of this varies per state and country. Check your local laws and regulations to make sure you’re well-informed.

- Housekeeping and maintenance. Cleaning is one of the costliest aspects of short-term rental property management. If you want to get good reviews and maximize your occupancy, you need an efficient cleaning process that ensures your rental is always ready for the next guest. You can clean your Airbnb property yourself or hire a professional cleaning company, which can rake up the costs (especially considering the high standards of cleanliness guests have come to expect since the COVID-19 pandemic). Of course, you can always charge an Airbnb cleaning fee to cover your expenses. Just don’t forget to factor this into your initial calculations.

- Vacation rental insurance. Just like any other business, running an Airbnb has its risks. Most guests are perfectly well-meaning, but it’s still important to protect yourself against any potential damages or accidents. And the best way to do that is to take out vacation rental insurance for owners. Standard homeowners or landlord insurance doesn’t cover short-term rental activity, so chances are you’ll need to find a specialized provider who does. Insurance can be costly, so make sure you research your options before launching your Airbnb. If you’re looking for information on what to do if a guest damages your rental, check out our post on Airbnb’s damage policy.

- Furniture and amenities. Short-term rentals always need to be furnished. While this is – hopefully – a one-time expense, it’s still important to consider when embarking on your Airbnb journey. Since you’ll be competing with other Airbnb hosts in your area, you should also add some amenities to your rental that could help attract potential guests – such as air conditioning and kitchen equipment.

- Airbnb supplies. Airbnb rentals may be different from hotel rooms, but your guests will still expect a certain level of hospitality. This includes providing supplies that your guests will need to enjoy their stay. Some supplies, such as guest toiletries, toilet paper, and coffee will need to be refilled on a regular basis. Have a look at our Airbnb host checklist to make sure you’ve purchased all the essentials.

- Utilities and subscriptions. When you start receiving guests, your rental’s energy consumption will go up, and you’ll need to start paying higher water, gas, and electricity bills. Later on, you may want to install home automation devices to manage energy consumption and save on utilities. Plus, if you offer guests subscriptions such as Netflix or Hulu, you will have to pay for those as well.

- Airbnb host fees. Last but not least, keep in mind that Airbnb charges a commission on each booking made through the platform. Most hosts currently pay a 3% Airbnb service fee per booking – however, this is subject to change as Airbnb adjusts its business model. The Airbnb host fee is automatically deducted from the payout you receive from Airbnb once your guest has checked out, so it’s an expense that you don’t actually have to pay.

Step 3: Calculate your Airbnb profit

Now that you have an idea of your Airbnb revenue potential and your operating expenses, you can use a simple equation to calculate your Airbnb profit.

Take your projected monthly rental income and subtract your projected monthly expenses. And there you have it. That’s how much profit you’ll be making by starting an Airbnb.

Is Being an Airbnb Host Worth It?

Becoming an Airbnb host can be extremely rewarding – and not just in a financial sense. Depending on how hands-on you decide to be as a short-term rental manager, you can meet lots of different people from around the world, contribute to their travel memories, and give them an amazing guest experience.

Of course, an Airbnb business is a business, so it has to be financially viable. And the best way to make sure that your Airbnb works for you, not the other way around, is to automate as many of the processes involved in managing a short-term rental as you can. This way, managing your rental won’t eat up all of your time, and you can be an efficient host while getting great returns.

How to start automating your Airbnb

Here are ways to save time by automating your Airbnb rental:

- Automate your guest communication. Start by putting the most time-consuming aspects of running an Airbnb on autopilot. Tools like Host Tools allow you to send automated messages to your guests so you can keep your response rate high (which is essential for achieving Airbnb Superhost status) without having to spend hours a day on guest messaging.

- Automate your check-ins. Instead of doing in-person meet-and-greets, you can automate your check-ins and check-outs by opting for Airbnb self check-in and installing a smart lock or other keyless entry solution in your rental. Host Tools allows you to automate smart locks by automatically sending a unique access code to your guests that they can use to let themselves into your rental.

- Automate your Airbnb pricing. Of course, making your Airbnb profitable will greatly depend on your Airbnb pricing strategy. If you set the same nightly price for every day of the year, on some days your price will be too low and on other days it will be too high based on fluctuating demand. You’ll either lose out on bookings or leave money on the table. To avoid this, consider using an Airbnb pricing tool to automate your rates. Host Tool has a rule-based pricing tool that allows you to set the best possible price for your rentals each day.

- Automatically sync your channel calendars. An important step in becoming an efficient Airbnb host is using software to synchronize your channel calendars. You need to do this once you start listing your rental on multiple booking sites, not just Airbnb. To avoid getting double bookings – when two guests book your rental at the same time on two different booking sites – you need to make sure your availability calendars are connected and automatically updated on all your channels. The Host Tools Airbnb channel manager can do this for you.

- Automate your Airbnb cleaning. Your rental may not be able to clean itself, but what you can do is automate your Airbnb cleaning workflows to avoid wasting time on scheduling cleanings, sending back and forth messages to your cleaners, and trying to keep track of cleaning supplies. Host Tools allows you to send automatic text messages to your cleaners whenever you need their help. This makes managing your cleaning much more efficient.

And now, let’s look at some of the most commonly asked questions about starting a profitable Airbnb business.

How Much Does it Cost to Start an Airbnb?

There’s no simple answer to this question. The cost of starting an Airbnb depends on a number of factors that are unique to you. For example, do you already own a property that you’d like to turn into a short-term rental, or are you looking to buy? In the latter case, your initial costs will be much higher, as you’ll need to purchase a property and take out a mortgage.

Secondly, you’ll need to furnish your property before you can start hosting Airbnb guests. Good quality furniture can cost around $1500 per room: the total expense will depend on the pieces you pick and the number of rooms you have. Then, you’ll need to purchase basic amenities and supplies, take out vacation rental insurance, and potentially get a business license (if required in your area). Listing a home on Airbnb is free, but you need to pay a 3% commission per booking.

Check out this guide to furnishing your short-term rental on a budget of $500!

Is it Worth Buying a House for Airbnb?

Buying a property with the purpose of turning it into a short-term rental can be a good investment strategy. After all, you can earn much higher amounts by renting it out on a short-term basis instead of having long-term renters.

Eventually, the property will pay for itself. However, the specifics of this strategy will depend on your local real estate market and the demand for short-term rentals in your area. Demand will be higher in New York or San Francisco than many other places, but the cost of buying property will also be high. Make sure to do some market research before you commit.

What Percent Does Airbnb Take From Hosts?

Currently, Airbnb charges a 3% commission per booking for most hosts. This can be higher for hosts on Airbnb Plus, hosts with rentals in specific markets like Italy, and hosts who choose to apply a Super Strict Cancellation Policy. Most guests are charged a service fee of under 14.2%.

Airbnb also has an alternative fee structure called the host-only fee structure, which is optional for most hosts but mandatory for hosts who connect to Airbnb through certain software platforms like channel managers. Hosts on the host-only fee structure pay a commission of 14-16% per booking, covering the entire service fee for the guest.

Can I Make a Living Off Airbnb?

Whether you can make a living off Airbnb depends on how much you’re earning per month and how much you need to spend to sustain yourself. If your Airbnb profits match or exceed your living expenses, you can make a living off Airbnb.

However, if they don’t, you should look at Airbnb as a side hustle for the time being and find ways to make it more profitable for you. It’s probably not a good idea to give up your job and go full-time until you earn enough from Airbnb to provide for yourself and your family.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!