Running any kind of business has its risks – and short-term rentals are no exception. If you decide to rent out your vacation home, you need to make sure that you protect it against unprecedented damages and incidents. After all, things go wrong all the time: even the most well-meaning guests can cause damage or be involved in accidents.

The only way to make sure that you, your property, and your renters are protected is to take out vacation rental insurance. However, it’s not as easy as it sounds.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!

Have you ever wondered:

-

What makes insurance for vacation rentals different from standard homeowners policy?

-

What type of coverage do you need?

-

Which providers insure vacation rentals and what is the best option?

-

How much does insurance for vacation rentals cost?

-

How do you file a claim?

If you have, you’ve come to the right place. I recently noticed just how often questions concerning insurance come up in short-term rental groups and forums. So, I decided to dig deeper into the topic.

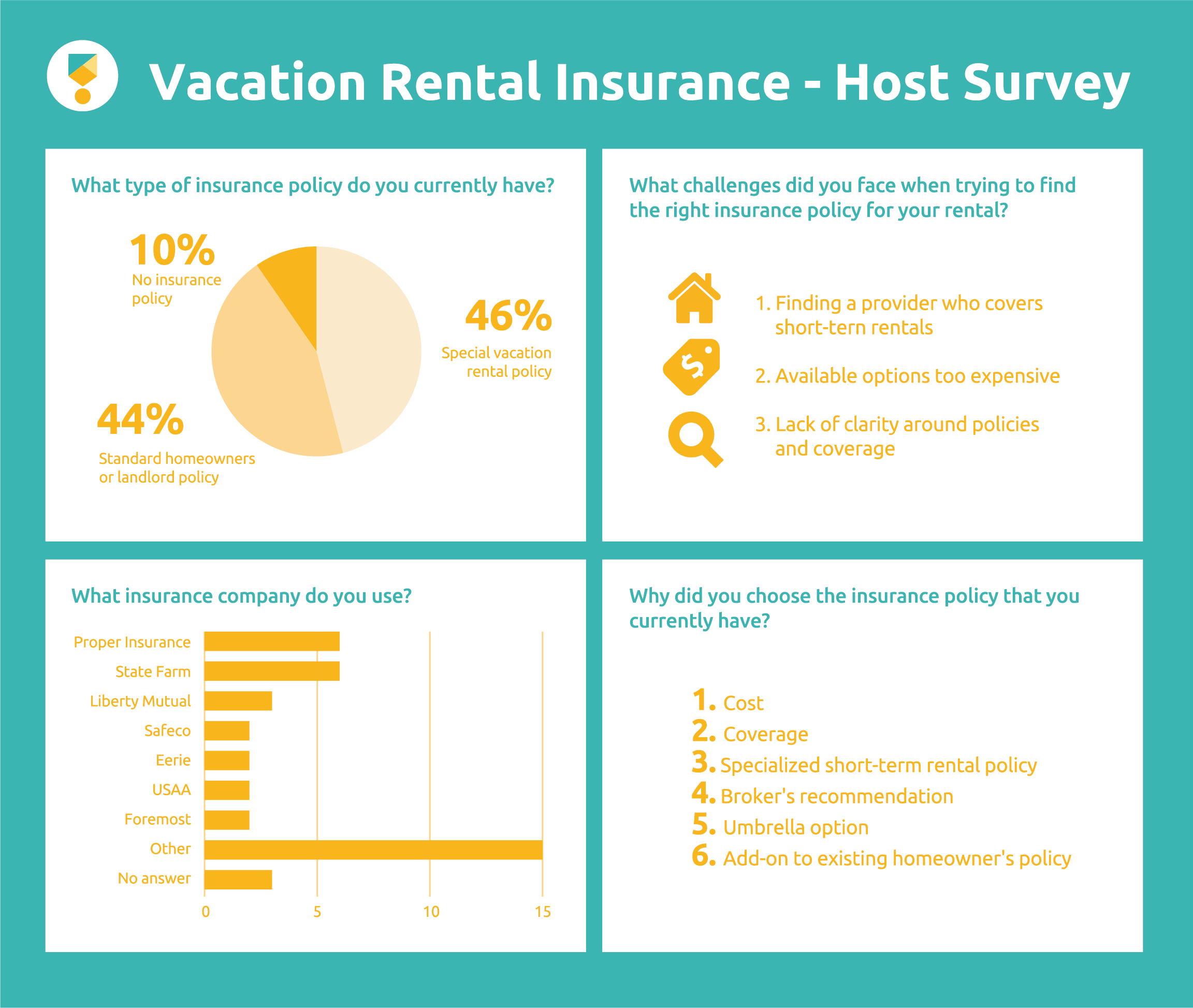

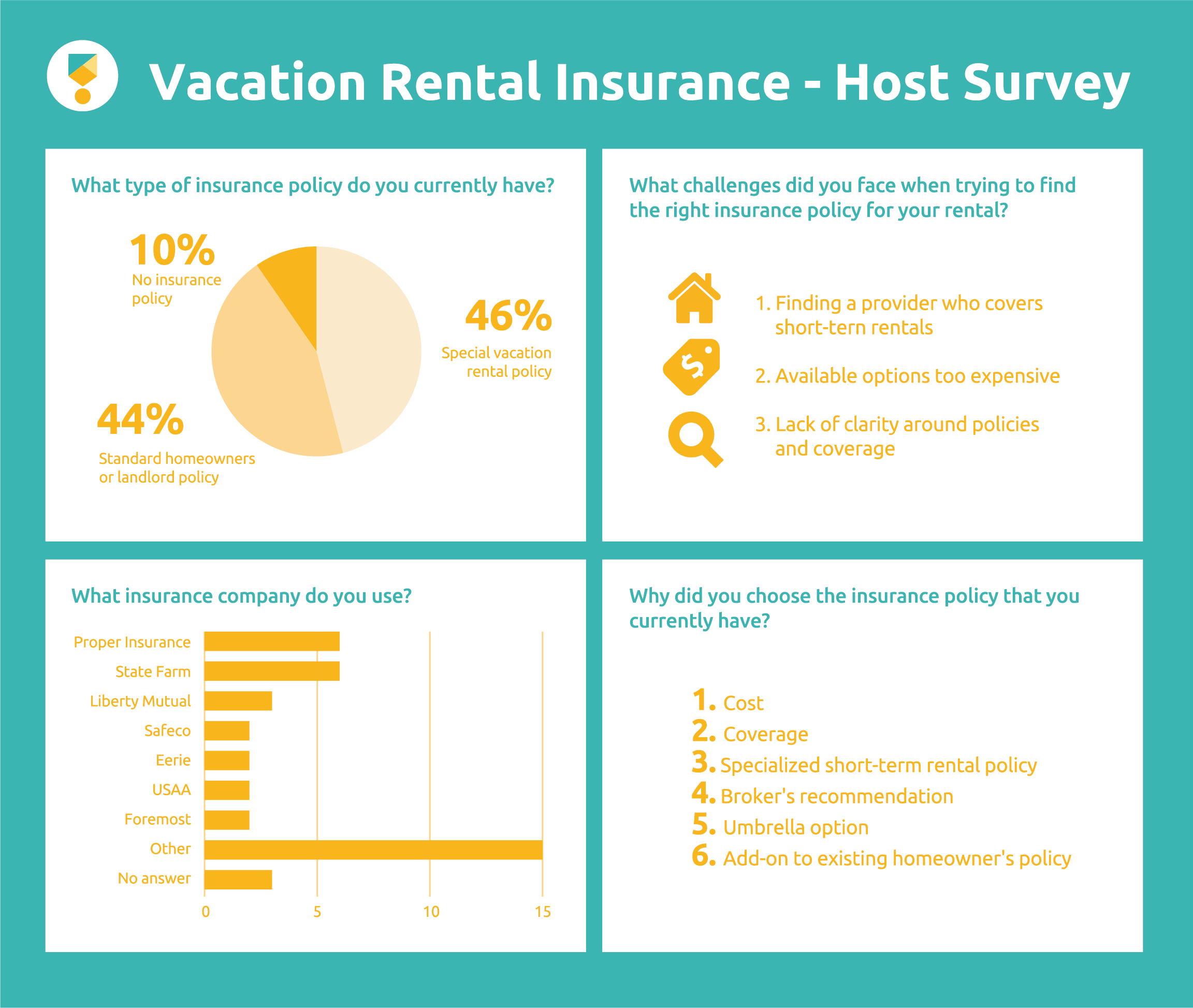

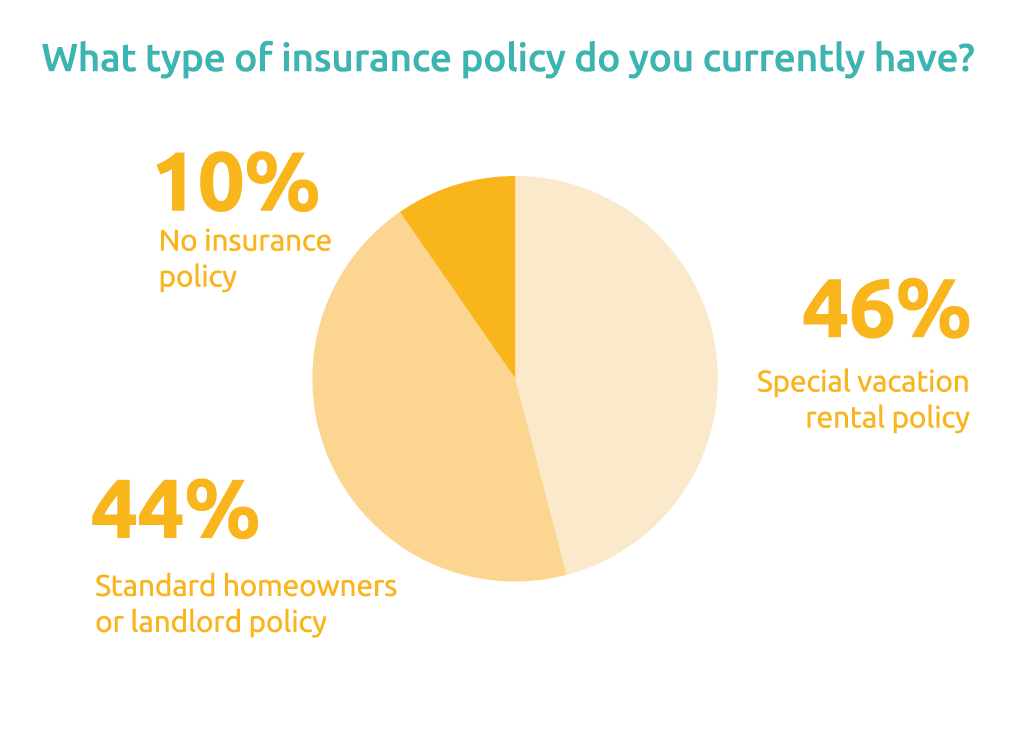

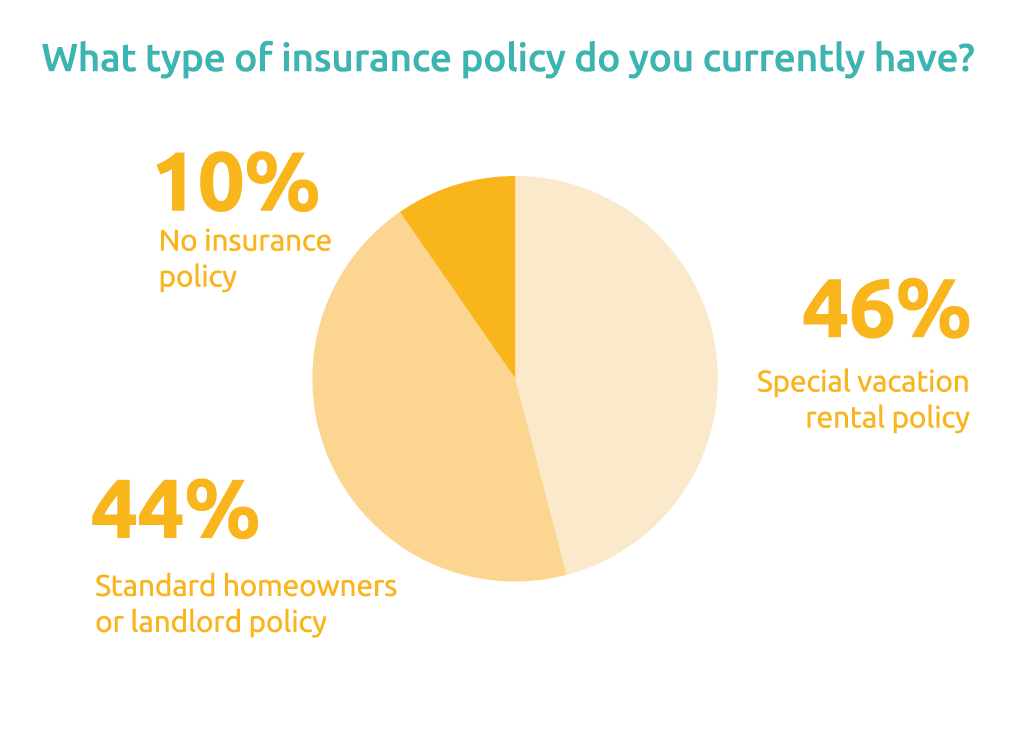

I sent a survey to my community of US-based short-term rental hosts, asking them about their experience. 41 hosts came back to me with lots of useful insight, which I’m going to share with you below. I’ve summed up the main takeaways in an infographic.

If you want to find out what my research turned up about the best insurance providers for vacation rental owners, read on to the end of this blog post!

What Kind of Insurance Do I Need for a Vacation Rental?

The simple answer is: you need a specialized policy that covers vacation rentals. Here’s why.

Your personal insurance policy – whether that’s a homeowner, landlord, or condo policy – does not automatically cover everything that you need it to cover as a short-term rental host. You may be able to purchase add-ons and extend your current policy. However, not all insurance carriers have this option.

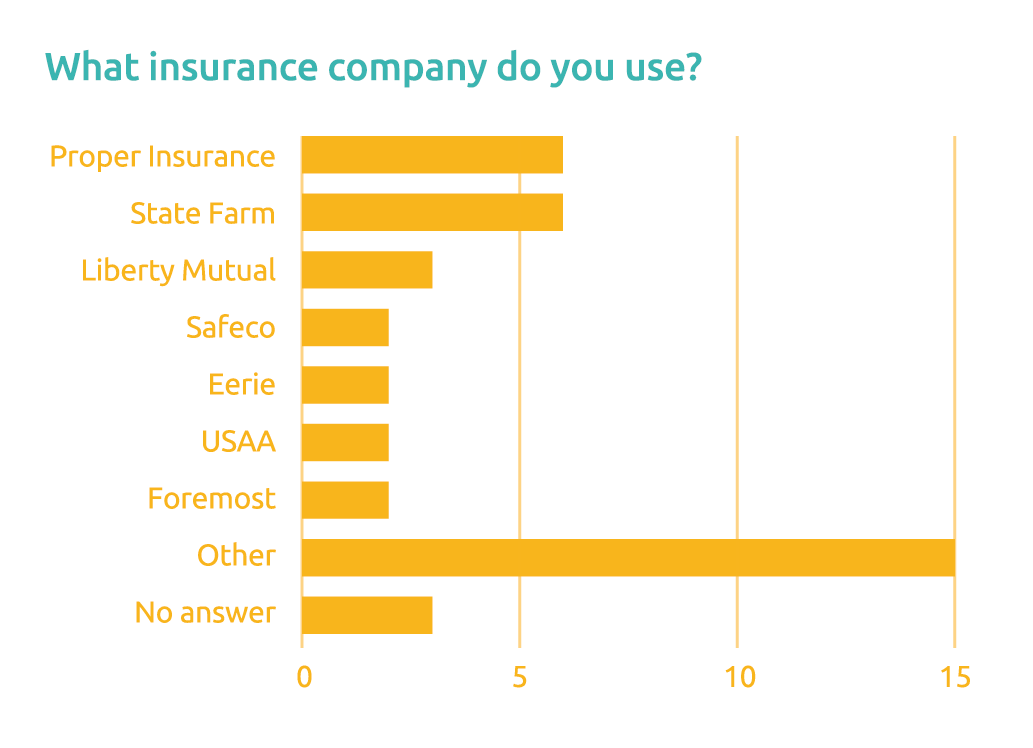

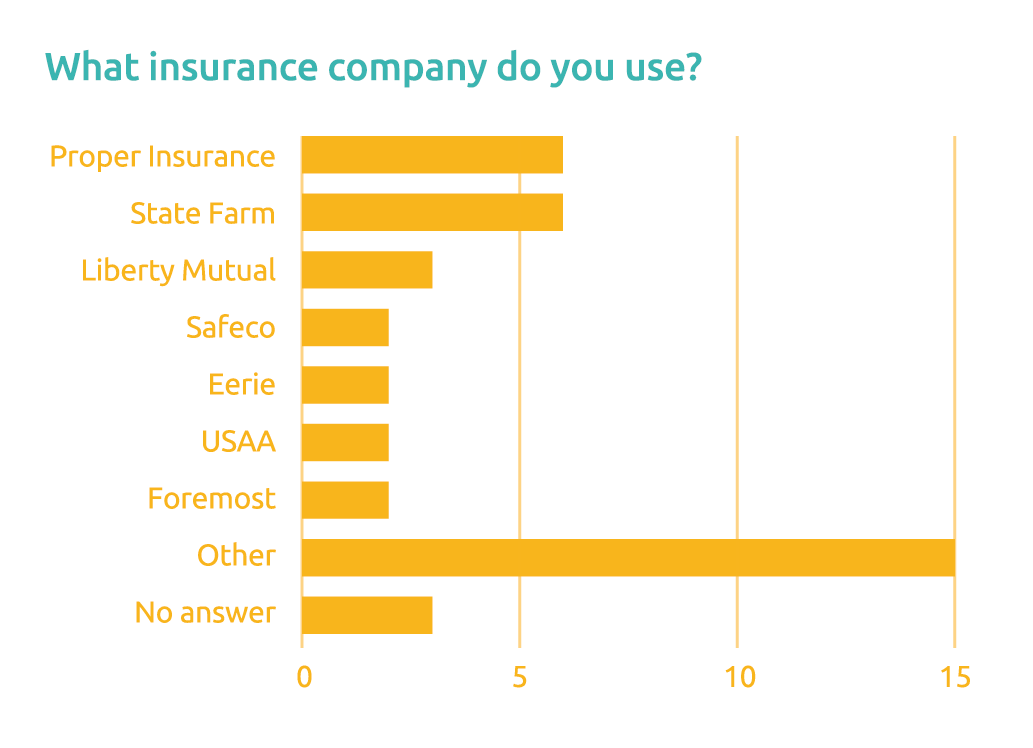

Results of our survey of 41 short-term rentals hosts in the US.

Another way to go is to take out a business insurance policy. However, even these can have restrictions around renting out your home on a short-term basis. And, business insurance policies tend to be extremely expensive for hosts – no one wants insurance fees to cut into their rental income.

But what about the policies that platforms like Airbnb and Vrbo offer?

Results of our survey of 41 short-term rentals hosts in the US.

Why you shouldn’t rely on channel policies

If you advertise your rental on channels like Airbnb and Vrbo, you may be tempted to rely on their policies. However, you should know that the policies offered by booking platforms are often not actual insurance policies. And, they definitely don’t provide sufficient coverage for your short-term rental.

Let’s take Airbnb, for instance.

There’s a policy called AirCover for Hosts which provides hosts with up to $1 million damage protection and up to $1 million liability protection. Previously, Host Protection only covered up to $1 million in both damage and liability protection. Airbnb AirCover is free and included in your host profile. You can utilize its benefits for every night your property is booked.

However, AirCover is not an insurance policy, and it doesn’t cover all damages to your property. It has a lot of terms, conditions and exclusions.

AirCover does not cover:

- Damage from normal wear and tear of the property

- Loss of currency

- Loss due to acts of nature (like hurricanes and earthquakes)

- Injury or property damage to guests or others

- Other exclusions may apply

AirCover does include Host Liability Insurance. AirCover protects you from liability if a guest is injured, or their belongings are damaged on your property. Additionally, it will protect you from responsibility if a guest damages a common area such as a condo lobby or your neighbor’s fence. While AirCover is very good, you’ll still want to invest in short-term rental insurance to ensure your property damage and liability protection at all times.

Additionally, in the case of channel policies, the agreement is not in the host’s name but in the channel’s. This means that you can’t go straight to the insurer when filing a claim: you need to go through the channel, which can slow down and complicate the process. Not ideal when you’re trying to get reimbursed for damages. Learn more about AirCover here.

Related post: check out guide on Airbnb’s damage policy and how to submit damage claims through the platform.

What Should My Vacation Rental Insurance Policy Cover?

The extent of the insurance coverage you choose for your vacation rental will vary depending on what type of property you have and where it’s located. It’s important to choose your coverage well: you probably don’t need the most expensive package (which insurance companies will try to sell you) but the most basic option may not be enough to cover your needs either.

In general, the three things that every host’s insurance policy should cover are:

- Property protection. It’s unlikely that your guests will intentionally cause damage to your rental, but accidents can and do happen. Make sure that your property and all of its contents are protected by insurance, so you won’t have to dig deep into your pockets if you need to repair or replace something.

- Liability coverage. Your insurance should not only protect your property but also eliminate the risk of liability should a guest get hurt or injured while staying at your property. In the rare event that a guest sues you for an accident or injury sustained at your property, you’ll need liability insurance to cover the legal fees.

- Loss of income. This aspect of short-term rental insurance is often overlooked even though it’s extremely important. Your insurance policy should provide coverage for a potential loss of income in case, because of some kind of damage, you’re unable to rent your property for a period of time.

There are a few other things to look out for when choosing your coverage.

Homesharing is all about trust – however, hosts do have to deal with bad actors sometimes. To avoid having to pay to replace stolen items, make sure that your rental is insured against theft, too.

Furthermore, it may be wise to choose a policy that covers bed bug infestations and similar damages.

If your property is located in a coastal area or other location prone to extreme weather conditions or natural disasters, it’s a good idea to take out insurance that covers damages caused by weather-related incidents, too.

How Much is Insurance for a Vacation Rental Property?

The cost of your insurance policy will depend on where your rental is located, what its characteristics are, and what type of coverage you choose.

Some providers offer the opportunity to pay only for the days when your rental is booked, which can be a significant advantage for hosts who only rent their homes during certain times of the year.

Other providers have monthly or yearly plans. You can usually get discounts if you decide to pay for a year in advance.

Which Insurance Companies Cover Short-Term Rentals?

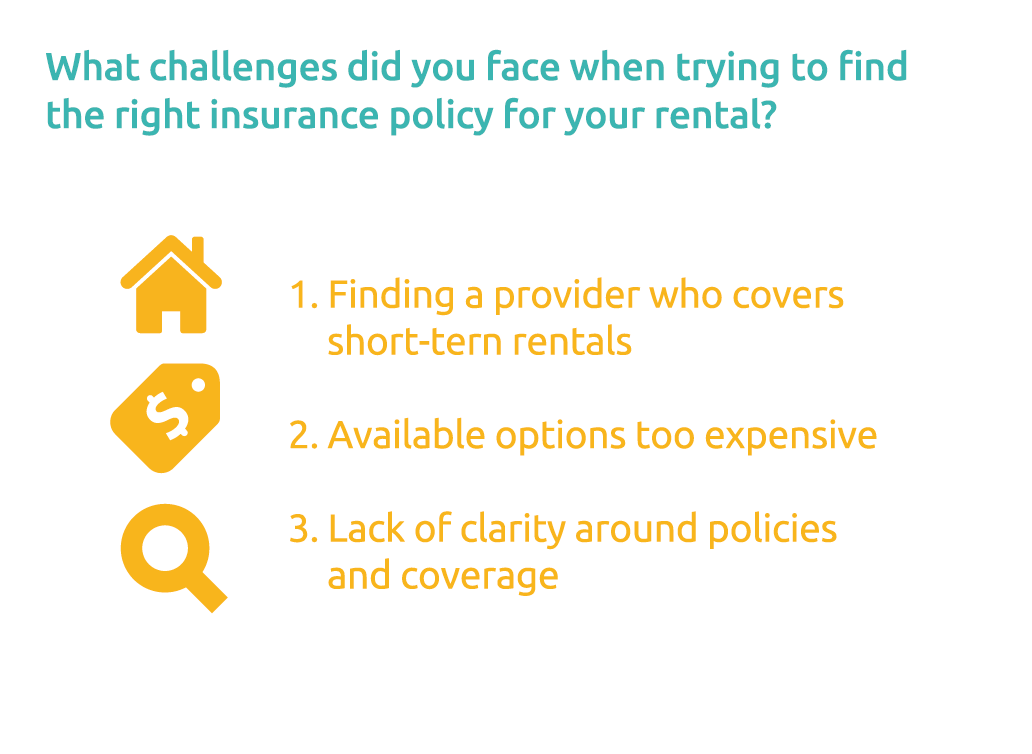

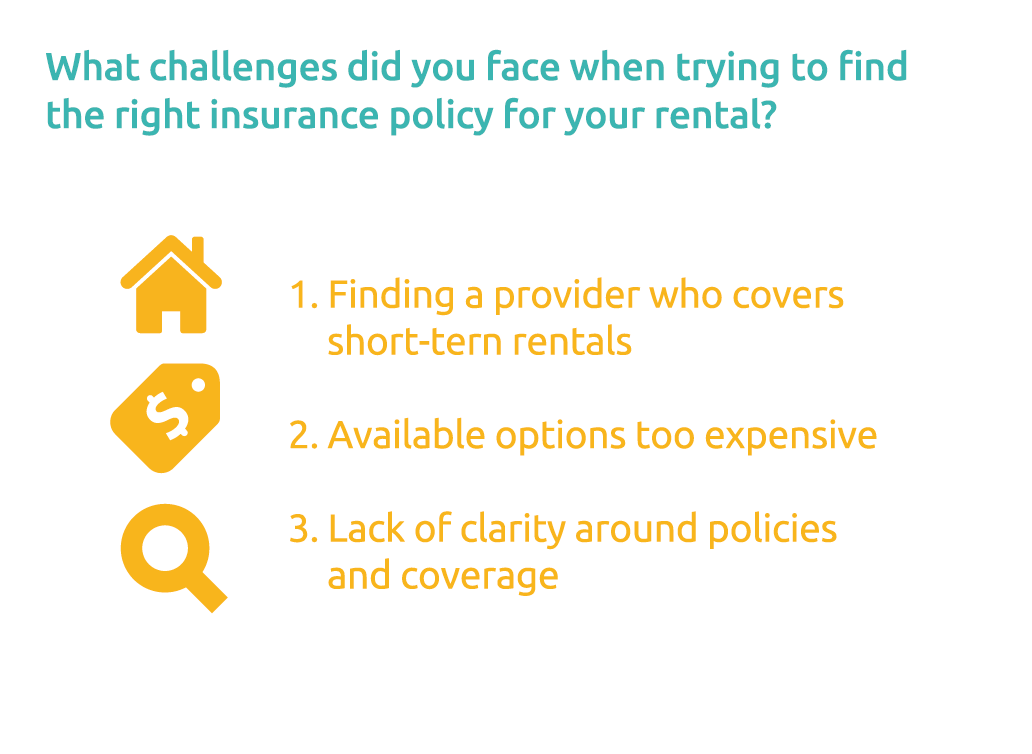

According to the results of our survey, the main challenge that hosts face when trying to take out insurance is finding a provider who covers short-term rentals. The options are limited and vary from state to state. Plus, available policies are often too expensive for small-scale hosts.

The hosts who responded to the survey also pointed out that there’s a lack of clarity around policies and what they cover. Several hosts said they had trouble finding useful information about vacation rental insurance providers and their policies online.

Results of our survey of 41 short-term rentals hosts in the US.

So what options are there, and which provider is the best?

Our survey showed that well-known providers like Proper Insurance and State Farm are popular among short-term rental hosts. However, not all of them are happy with their current policies: for example, a few hosts mentioned that Proper Insurance had significantly increased their premium this year, which had a tangible impact on their business’s bottom line.

Results of our survey of 41 short-term rental hosts. The ‘Other’ category groups together the providers that received only one vote each.

Luckily, the range of choices is growing. An increasing number of insurance providers are adding new products to their offering that are tailored to the needs of short-term rentals.

Furthermore, startups partnering with established insurance companies are developing innovative technology platforms to streamline the process by allowing property managers to take out insurance and file claims online. These vacation rental host tools help you save time by by automating your insurance claims and management – which is a huge step toward automating your Airbnb rental.

So, instead of talking about the big insurance providers that you may already know, we’d like to offer a few alternative options that could work well for short-term rental hosts. These companies provide special policies for vacation rentals at an affordable rate to help you protect your rental property without breaking the bank.

1. InsurStays

InsurStays provides a wide range of insurance policies for vacation rental hosts and property managers. They partner with insurance agents, brokers, and high-rated underwriters to provide protection at affordable prices. And, they also partner with innovative distribution platforms like RentalGuardian where hosts can access the automated online claim management system.

InsurStays has a few different property protection programs. One of them is the StayProtect Property Protection policy. This comes in two different packages: property owners can either choose the Liability Bundle or the Contents Only package.

The Contents Only package provides coverage for damages to flooring, carpeting, drywall, appliances, furniture and other contents of the rental. This way, you can eliminate the need for security deposits and receive the full replacement cost of damaged items.

The Liability Bundle, on the other hand, includes not just damage coverage but also business liability insurance and bed bug protection. This comprehensive coverage works to provide complete protection for you and your rental.

InsurStays’s policies are underwritten by Lloyds of London, one of the most trusted insurance companies in the world.

Pricing: Flexible pricing based on market needs and coverage levels.

Where is it available? StayProtect Property Protection is available US-wide.

2. Velocity

Velocity Risk Underwriters is a company that has recently expanded its insurance policy offering to short-term rentals.

Next to their homeowners insurance policy, they now cover short-term vacation rental properties rented frequently as well as second homes rented occasionally. As such, they can assist with a rental’s unique coverage needs.

Velocity specializes in coastal insurance and covers properties in areas exposed to natural disasters. They promise the fastest and fairest coverage in the wake of catastrophes. So, if you have rentals on the coasts of Florida or other coastal markets in the US, Velocity could be the right choice for you.

Examples of incidents that Velocity covers include:

- Fire

- Lightening

- Wind damage

- Hurricane

- Earthquakes (in some states)

- Liability

- Theft

Some of Velocity’s most commonly covered losses are water damage, fire and smoke, freezing of plumbing, windstorm or hail, theft, and falling objects. However, there are many other coverage options available that you can include in your policy.

If you need to file a claim, you can do so online on Velocity’s website.

Pricing: Reach out to Velocity for a quote.

Where is it available? At the time of publishing, Velocity homeowners insurance is currently available in these states: Connecticut, Florida, New Jersey, New York, North Carolina, and Texas.

3. American Modern

American Modern Insurance Group is a large-scale insurer. They are widely recognized and have been in business for over fifty years. The insurance group has over 1,200 employees and works with their nationwide agency partners to find coverage for their clients.

American Modern offers packages for different types of vacation properties: short-term rental and occasional rental hosts.

-

Short-term rental or vacation home coverage: For the host who intends to rent their space as often as possible. This package is most beneficial for properties that expect to rent at least 62 days per year. An example of this type of host: the property is located in a hot spot of downtown New York City near Times Square and never struggles for tourist visits.

-

Occasional rental or vacation home coverage: For the host who intends to rent their property less than 62 days per year. The occasional rental package is best for those owners who plan to live in the property for a portion of the year. Example: An older couple rents out their northeastern two-bedroom home while they “snowbird” in Florida.

American Modern short-term rental packages include varying options of income loss, property damage, and liability coverage. These options are cheaper when bundled together to create a full short-term rental insurance plan. While their plans generally do not include furnishings, other structures, or pools and garages, special accommodations may be made on a case by case basis.

Pricing: Reach out to American Modern for a quote.

Where is it available? Nationwide.

4. CBIZ

CBIZ Vacation Rental Insurance is a subsidiary brand of CBIZ, Inc. They focus solely on providing owners with short-term rentals protection and insurance policies.

Founded in 2002, CBIZ was the very first to create an insurance policy just for short-term rental properties. They operate in all 50 states and received an A+ rating from the Better Business Bureau.

CBIZ Vacation Rental Insurance offers comprehensive coverage in their policies and is the largest vacation rental insurance provider in the nation.

Pricing: Reach out to CBIZ for a quote.

Where is it available? Nationwide.

5. American Family

American Family Insurance offers a Vacation and Second Home Insurance policy as one of their many homeowner’s insurance options. This company handles many types of policies, including auto, home, renters, and life insurance.

Founded in 1927, American Family Insurance operates in 17 states including Arizona, Kansas, Ohio, Colorado, Minnesota, Oregon, Idaho Missouri, South Dakota, Illinois, Nebraska, Utah, Indiana, Nevada, Wisconsin, Iowa and North Dakota.

They also received an A rating from the Better Business Bureau. They are dedicated to giving back to their communities and are passionate philanthropists as well.

Pricing: Roughly $2,000-$3,000 per year.

Where is it available? Available in 17 states.

Host Tools provides an automated, unified calendar for short-term rental hosts, allowing you to seamlessly list on all major channels. Start your free trial today!